Real estate represents the largest asset class in the United States, comprising 43 percent of America’s total wealth, yet only 3% of total charitable giving comes from such gifts. Real estate is often overlooked as a powerful charitable giving asset for two reasons:

- Donors do not realize they can give real estate directly to charity; and

- Gifts of real estate are complex, often involving a team of experts to execute.

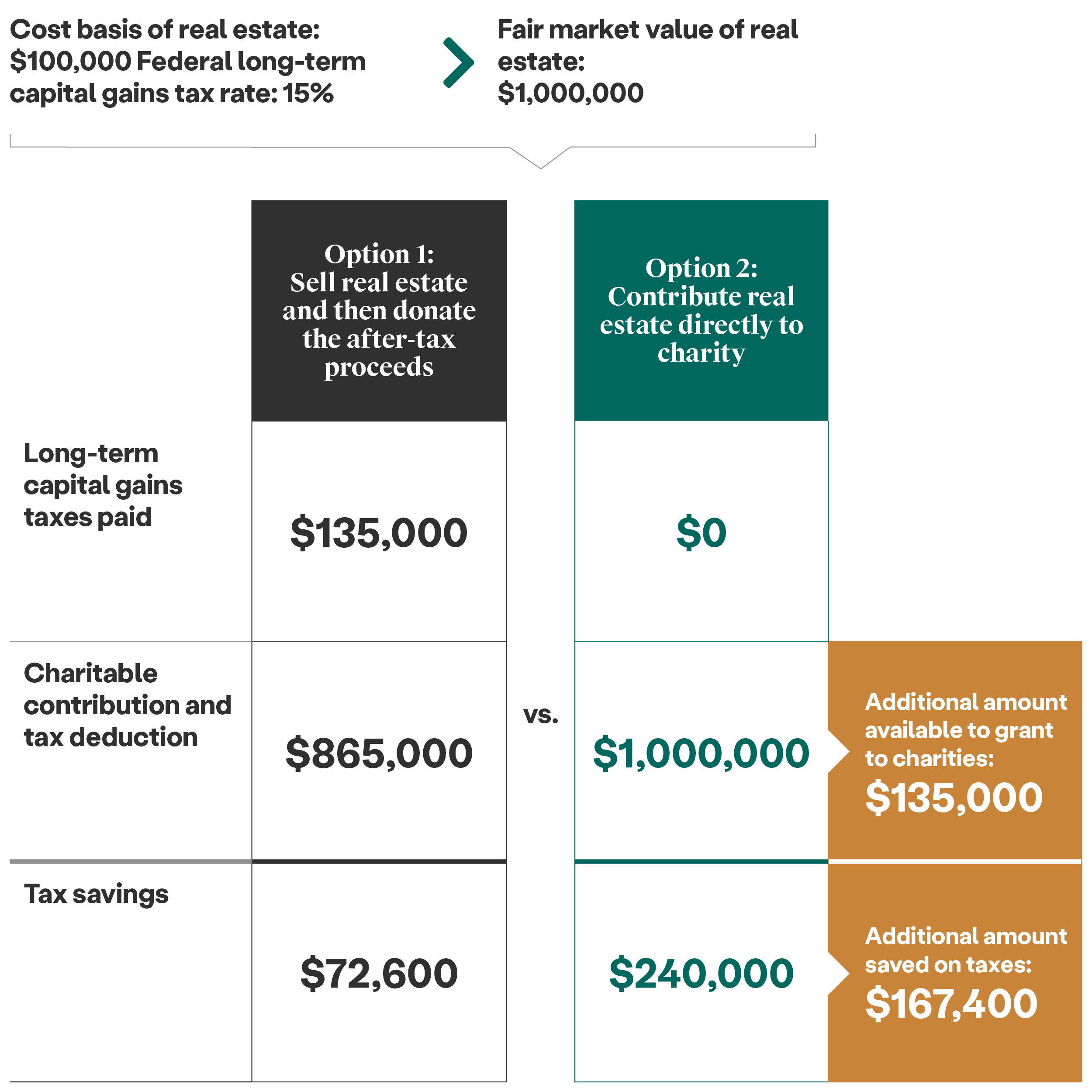

While charitably-minded individuals may find it easier to sell their appreciated land or real estate and then make their donation to charity, the truth is donating the after-tax proceeds diminishes the size and impact of your gift.

This example illustrates the capital gains and tax savings benefits for a donor who gifts his property valued at $1 million directly to charity (Option 2), rather than selling his property and donating the after-tax proceeds (Option 1).

Benefits for Donors

Direct gifts of real estate to 501(c)3 public charities can provide significant benefits for philanthropists. Donors can:

- Avoid paying capital gains tax on the sale of the real estate;

- Receive a charitable income tax deduction based on fair market value of the property;

- Increase your income for retirement with a charitable gift annuity or charitable remainder trust;

- Complement the unique advantages of your private foundation;

- Make a greater philanthropic impact; and

- Leave a lasting legacy for you and your family.

However, all charities are not equipped to receive or process complex gifts like real estate.

Benefits for Nonprofits

While gifts of real estate offer immense potential for nonprofits, many organizations lack the infrastructure or expertise to accept them. However, embracing real estate giving can be transformational for nonprofits in three key ways:

- Diversification of Funding Sources: Real estate gifts offer nonprofits a diversified revenue stream, reducing reliance on traditional funding sources and enhancing financial stability.

- Tax-Smart Philanthropy: Accepting gifts of real estate enables nonprofits to provide donors with tax-efficient giving options, attracting more substantial contributions and fostering long-term donor relationships.

- Strategic Growth: Real estate gifts can facilitate strategic growth initiatives for nonprofits, such as expanding programs, acquiring new facilities or investing in long-term sustainability projects.

Partner with SDF to Accept Real Estate Gifts for Your Organization

Charitable Real Estate Foundation

At SDF, we understand the transformative power of real estate giving for both donors and nonprofits. Through the Charitable Real Estate Foundation (CREF), a supporting organization of SDF, we provide comprehensive support and expertise to facilitate real estate donations.

- For Donors: The CREF board provides oversight and guidance for our Giving Team, as we help donors and professional advisors tap into the substantial benefits of donating real estate assets and give a timely, accurate indication of the potential gift value of the property. Whether you’re considering a direct gift of real estate to charity or a donor-advised fund (DAF), we tailor our services to maximize the impact of your donation.

- For Nonprofits: We partner with nonprofits to develop customized strategies for accepting and leveraging gifts of real estate. From due diligence and legal compliance to asset management and liability concerns, our collaborative approach ensures nonprofits can realize the full impact of real estate gifts. The CREF board is our expert team to guide nonprofits during the gift acceptance process – evaluating, accepting and leveraging real estate gifts to fuel the mission of impactful organizations.

“We partnered with San Diego Foundation to donate our family condo in Oregon to our donor-advised fund,” said SDF donor Jim Ward. “We relied heavily on their expert staff to guide us through the steps needed to maximize our donation and avoid paying unnecessary capital gains tax.”

“I felt comfortable and secure donating my real estate to San Diego Foundation,” said donor Mike House. “I was getting the best advice and was able to lean on the team to maximize my gift.”

At SDF, we also collaborate and work closely with your team of experts, including professional advisors such as accountants, tax attorneys, and estate planning attorneys, for gifts of real estate.

“The Foundation has been my partner in philanthropy for many years,” said Laura Nichols, Certified Specialist in Estate Planning, Trust & Probate Law at Buchalter Law Offices. “My clients and I work with their giving advisors to realize estate planning goals, which often include using sophisticated trusts to increase charitable impact and maximize tax deductions,” she added.

Whether you’re a donor looking to make a meaningful impact or a nonprofit seeking to diversify funding sources, SDF is here to help you unlock the full potential of real estate giving. Contact us today to learn more about how we can support your philanthropic goals and create lasting change.