The National Philanthropic Trust, which has tracked donor-advised funds for more than a decade, reported in the 2017 Donor-Advised Fund Report that donors contributed $23 billion to about 285,000 donor-advised funds in the U.S. and used these donor-advised funds to recommend almost $16 billion in grants to qualified charities.

Both grants and contributions are record highs.

What are donor-advised funds? And how have they quickly become today’s fastest growing charitable giving vehicle?

A donor-advised fund is a philanthropic giving vehicle administered by a charitable sponsor, such as a community foundation (like The San Diego Foundation) or commercial institution. Donors establish donor-advised funds with a charitable sponsor, fund the account with an irrevocable, tax-deductible contribution and receive an immediate tax deduction.

The charitable sponsor invests the funds, and donors then recommend grants from those funds gradually, over time, to other charitable organizations.

Why are donor-advised funds skyrocketing in popularity among philanthropists?

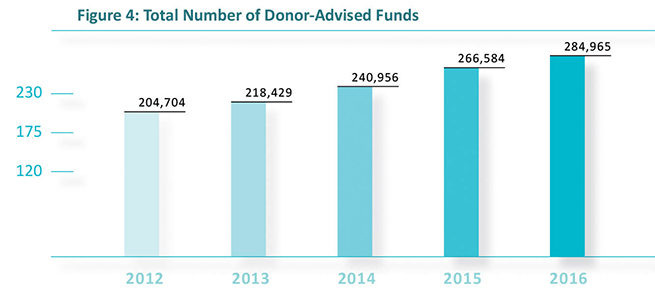

In 2016, donor-advised funds saw steady growth in grant dollars, contributions, charitable assets and number of donor-advised funds.

Source: 2017 Donor-Advised Fund Report by the National Philanthropic Trust.

This can be attributed to four primary reasons:

- Donor-advised funds accept cash and non-cash assets like stock, real estate, partnership interests, life insurance and more. As U.S economic indicators have experienced steady growth in recent years and investments have performed strongly, donor-advised funds have provided philanthropists a vehicle to deposit assets without paying capital gains tax.

- Donor-advised funds allow donors to invest and grow their money over time and give it to a nonprofit organization of their choosing. While they receive the immediate tax deduction, a donor isn’t forced to select a charity the moment he or she establishes the fund.

- Donor-advised funds are a hybrid between a private foundation and giving directly to a nonprofit organization. Philanthropists can invest their funds and choose where to give over time. A major benefit it is the charitable sponsor handles all the administrative aspects and, in many cases, provides investment managers to help grow the funds. Also, there is also a lower barrier to entry with donor-advised funds. Donors may be able to open funds for $25,000, while private foundations typically cost much more to run effectively.

- Donor-advised funds allow for anonymity. Being that the charitable sponsor houses and manages the fund, grants are advised by the donor but given by the sponsor. Therefore, donors have the option to remain anonymous during the granting process.

Considering a donor-advised fund?

Speak to our Development & Stewardship Team to learn more about the benefits of a donor-advised fund, and jump start the fund process and your philanthropy to receive optimal tax benefits.

Contact our Development & Stewardship Team today!

Oops! We could not locate your form.