As the economy continues to grow, we recognize that recent shifts in the market have sparked plenty of questions among investors and donors alike wondering what the future holds.

- Is the current market volatility a sign of something greater?

- How are current economic conditions affecting the capital markets?

- How have recent trends impacted The San Diego Foundation investment portfolio?

At The San Diego Foundation, we believe it’s important to speak to these points and provide donors with continuous support and education regarding their charitable dollars. Whether that’s through quarterly investment webinars or the annual Investment Summit, transparency is at the forefront of The Foundation’s investment activity.

2018 Investment Summit: Performance & Trends

Recently, The Foundation held its 2018 Investment Summit with dozens of philanthropists eager to understand how our strong investment performance is helping to maximize the impact of charitable giving.

[pullquote]Transparency is at the forefront of The Foundation’s investment activity.[/pullquote]

The Summit provided a deep dive into current market trends and opportunities, and how they will impact and benefit our investment strategy in today’s ever-changing economic climate.

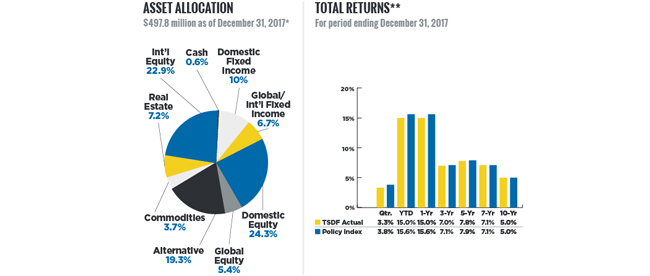

Investment Committee Chair Steve Klosterman began by reminding attendees of our commitment to managing portfolios in accord with UPMIFA, the Uniform Prudent Management of Institutional Funds Act. Steve also walked through important evidence pertaining to asset allocation. Studies have demonstrated that over 90 percent of an investment portfolio return can be attributed to asset allocation.

Following Steve’s opening, Investment Committee Vice Chair Kevin Hamilton spoke about the strengths of our Investment Committee, noting it’s the only Committee in which he has ever served made up almost entirely of investment professionals. With over 150 years of combined global and domestic expertise, our Investment Committee drives asset management and investment growth to meet fund objectives.

Kevin also outlined our long-term approach for managing institutional investments and our portfolios. We focus on finding undervalued asset classes, Kevin explained, while utilizing professional investment managers to invest within those asset classes. Our Investment Committee, our investment consultant, and I work tirelessly to achieve the best risk-adjusted returns we can for our constituents.

My presentation was focused on our investment performance. Four of the five investment portfolios we manage outperformed their Policy Index during 2017. Our Endowment Portfolio, which slightly lagged its Policy Index, still produced a 15 percent rate of return, twice that of its long-term objective of CPI + 5 percent.

Lastly, we invited Shelly Heier to join us. The President and COO of national investment consulting firm Verus Investments, Shelly addressed the capital markets. She noted that the lack of market volatility in 2017 was much more abnormal than the volatility we have already witnessed in 2018. She also noted the economic backdrop was strong, with very low levels of unemployment and low inflation. She believes the market is readjusting to a new paradigm of rising rates and the possibility of inflation.

Maximizing Your Charitable Investments

The Foundation manages your charitable dollars with a long-term, value oriented approach – the same model used by the most respected investment managers globally.

By pooling charitable assets, including more than $500 million in our Endowment Portfolio, we have significant economies of scale to invest with the best and brightest minds at a very reasonable overall investment cost. Most importantly, we build investment strategies that increase the impact of your charitable gift, create sustainable growth, and help you improve quality of life in San Diego and beyond.

Learn more about our investment portfolios today.

About Matt Fettig, CFA