Since 1975, The San Diego Foundation and our donors have granted more than $1 billion to advance a vibrant quality of life in San Diego.

While most often we talk about the significant impact programs and local donors have within our communities, behind the scenes our Investment Committee and I as Chief Investment Officer work to maximize the impact of our donors’ collective social investments by making prudent investment decisions and exercising responsible stewardship of more than $600 million in assets.

Our Quarterly Investment Conference Calls provide donors and their professional advisors with insights into the state of the market and current Foundation endowment and non-endowment portfolio investment performance.

We encourage you to listen to the latest Q3 call and review the slides shared from our team of experts to learn more about global trends, portfolio performance and market expectations.

[embedyt] http://www.youtube.com/watch?v=lTLu5QSHi4E[/embedyt]

Recent Trends

One week after the news of Donald Trump being elected the 45th President of the United States, Horacio Valeiras, Principal at HAV Capital and Foundation Board Investment Chair, and I spoke about how the election results have and will affect the market.

The most important thing to note is that short term swings immediately following Election Day are common, but don’t paint a complete picture of long term market trends. For example, since 1951, the immediate S&P 500 Price Return is more favorable when a Democrat is elected President compared to Republican, averaging an 11.7 percent return and 6.3 percent return, respectively.

However, when looking at one year after every election, which eliminates short-term volatility and rollover from previous administrations, the difference between Republican and Democrat Presidents is virtually nonexistent. This indicates that it’s unwise to use an election when determining how to invest.

As Horacio explained, “The party of the President rarely drives the market. Instead, it’s the specific policies enacted once in office that drive markets up or down.”

[Tweet “The party of the President rarely drives the market.”]

For example, expectations are that President Trump will spend more money on defense and infrastructure, and provide citizens with greater tax cuts. All of these policies combined have created greater market concern regarding inflation, causing yields for some U.S. bonds to rise.

On the flip side, the stock market has reacted positively. Financial and healthcare stocks are seeing strong appreciation because of the expectation of favorable policies under a Trump administration.

Ultimately, we will have to wait and see what policies the new President decides to enact before determining how the 2016 election shifted the market.

Portfolio Outlook

The Foundation Investment Committee takes a long-term, institutional approach to constructing investment portfolios.

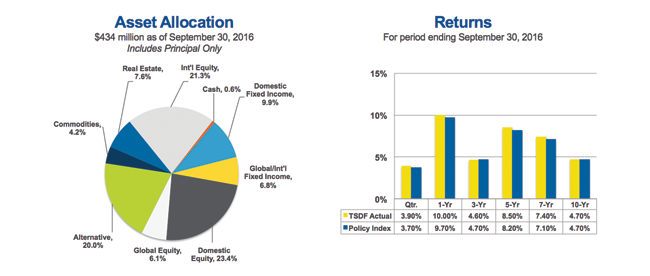

As we look at recent results and compare to our policy index, we are encouraged by strong performance in the previous quarter, as well as the past year. We are outperforming our policy index and the majority of our peers.

Specifically, over the last one year period, The San Diego Foundation Endowment Portfolio ranks in the 4th percentile among our peers, 1 being best and 100 being worst.

The reasons for this strong endowment performance are:

- We have had a deliberate tilt toward higher dividend paying companies for some time. That strategy has paid off in the past year as U.S. equities/stocks are exhibiting strong performance.

- Our exposure to emerging markets has been beneficial. This includes positions in both equities and sovereign debt.

- About one year ago we revamped the mix of our hedge funds, and we are now seeing the benefits of that move. While this area is still evolving, in the past few months, this part of our portfolio has shown strong relative returns.

On the call, Horacio and I discussed in more detail the impact of global trends and drivers of portfolio performance.

I encourage you to listen to the recording for further insight and information to help you maximize your charitable investments and grantmaking.

About Matt Fettig, CFA