Impact investing is on the rise.

In its latest annual survey, the Global Impact Investing Network (GIIN) estimates that over 1,720 organizations manage $715 billion in impact investing assets, up from $502 billion the previous year.

Although impact investing is an emerging asset class, it’s one in its infancy. And many people are still asking, “What is it?”.

According to GIIN, impact investments are investments made into companies, organizations and funds with the intention to generate positive, measurable social and environmental impact alongside a financial return.

Benefits include supporting sustainable community development and recycling philanthropic dollars back into communities to address systemic and emerging needs, such as homelessness, food insecurity and climate change.

Impact investors include community foundations, family foundations, health systems, banks, pension funds, insurance companies, faith-based organizations, corporations, wealth managers and individuals.

Why Impact Investing

Social good doesn’t always have to start and end with grantmaking.

Traditionally, philanthropy and investing have been viewed as two separate disciplines – one championing social change, the other financial gain.

Impact investing integrates these two approaches, presenting an innovative opportunity for philanthropists and investors to put their investment resources to work for social change.

Through impact investing, philanthropists can advance social and environmental solutions through investments that also produce financial returns.

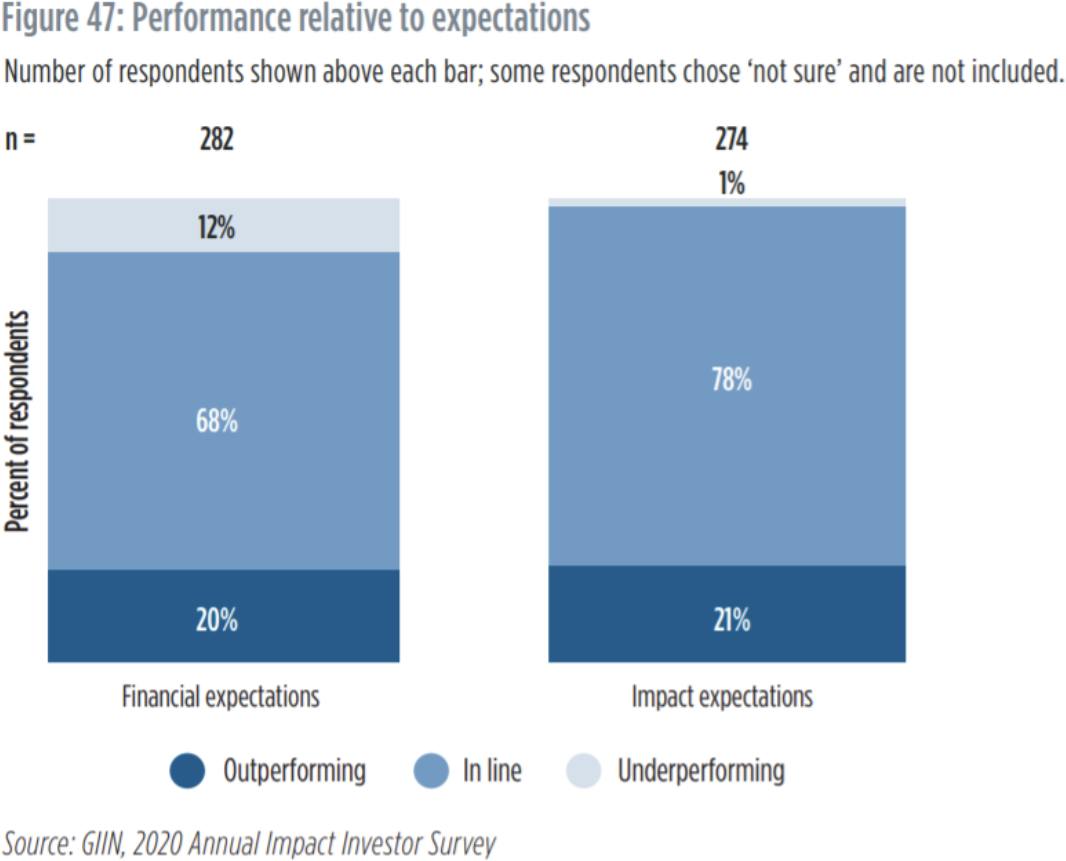

Most investors surveyed by GIIN pursue competitive, market-rate returns. Respondents also reported that portfolio performance overwhelmingly met or exceeded investor expectations for both social and environmental impact and financial return, in investments spanning emerging markets, developed markets, and the market as a whole.

Impact Investing Funds at Community Foundations

More than any nonprofit organization, community foundations have the ability to deploy a diverse set of tools to address community needs, including grantmaking, donor engagement, and investments.

As community foundations seek innovative ways to build community wealth and health, more are adopting impact investing strategies to meet growing needs.

The Democracy Collaborative outlines the four most common impact investing strategies by community foundations:

- Working with CDFIs: Community foundations invest through community development financial institutions (CDFIs), using their expertise in sourcing deals, due diligence, underwriting, and loan servicing.

- Creating Loan Pools: Using their own assets and those of donors, community foundations are creating separate loan pools to do loan lending, most often to nonprofit social enterprises and support affordable housing development.

- Loan Guarantees: Loan guarantees enable community foundations to reduce risk for other investors and leverage their impact far beyond the dollars they commit.

- Direct Local Investing: Community foundations make direct investments in nonprofits and social enterprises.

With impact investing, community foundations like The San Diego Foundation are facilitating investments for social good from donor-advised funds and recycling the investment returns on capital back to the fund to make future impact investments and grants.

Community foundation minimum investment requirements are typically less than an institutional impact investment fund due to a foundation’s ability to pool funds from multiple donor-advised funds, presenting social investment opportunities to philanthropists who otherwise would not have access due to barriers such as high minimums.

Impact investing makes community-connected capital available to nonprofits and small businesses committed to local economic opportunity and puts donor-advised funds to work for local communities.

Impact Investing Creates Real Impact

Community foundations across the U.S. are putting impact investing funds in place to maximize their impact.

The Greater Cincinnati Foundation, for example, launched the Affordable Housing Impact Investment Pool to help bridge Cincinnati’s affordable housing gap through the construction of high-quality rental units and the building of renters’ equity accounts. GCD donors make impact investments to the pooled fund through their donor-advised funds and new donations to combine their charitable investments for a larger impact.

Another example is the Arizona Community Foundation Community Impact Loan Fund. The fund offers loans to nonprofit community projects, often at or below market rates. As loans are repaid, funds become available for use with other projects, creating a continual recycling of charitable capital. Using loans, debt and loan guarantees, ACF has invested in innovative projects that advance education, healthcare and environmental sustainability in Arizona.

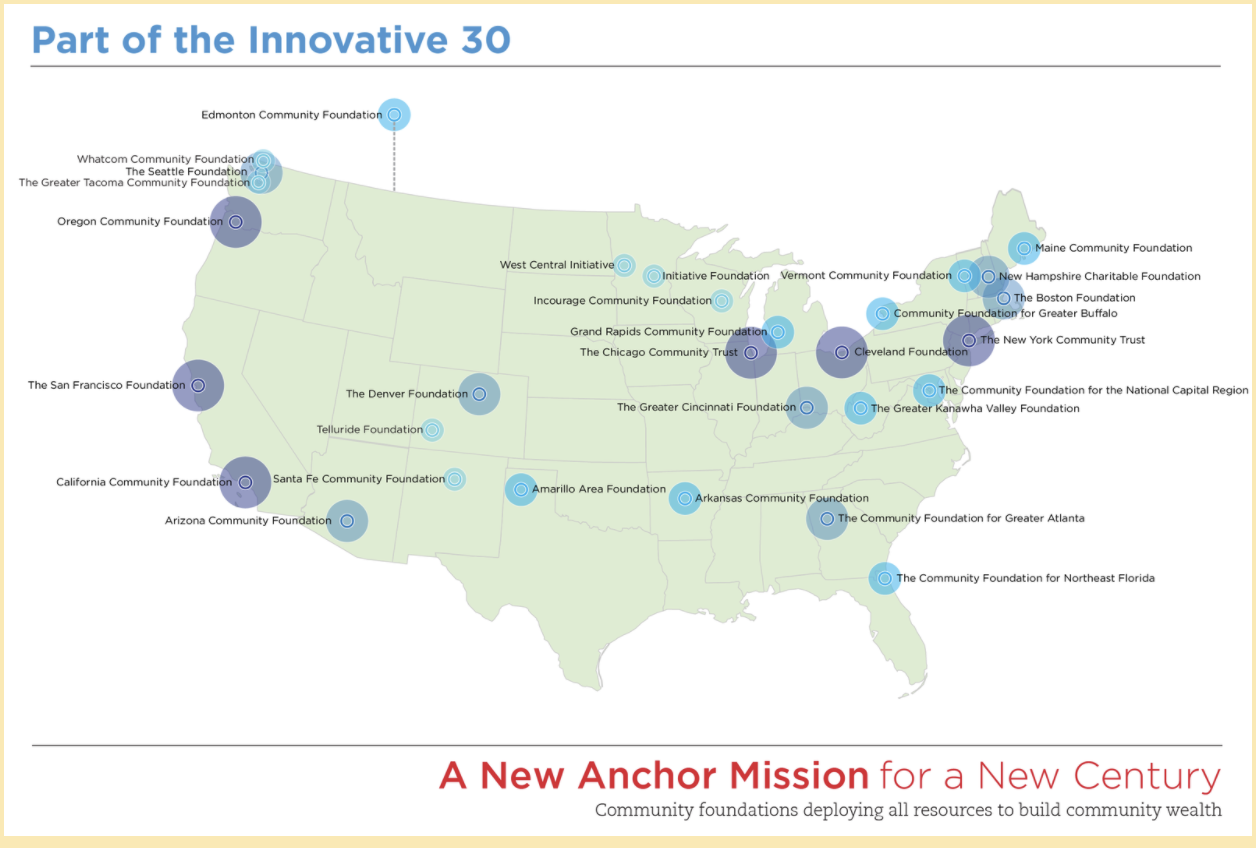

The most recent data shows more than 30 community foundations are utilizing some type of impact investing model.

Locally, The San Diego Foundation has partnered with impact investment firm Mission Driven Finance (MDF) to empower communities through new models of investing in social change.

Most recently, San Diego Foundation donors had the opportunity to invest in two MDF private debt fund opportunities through their donor-advised funds: The Advance Fund and the Homebuilding Investment Fund.

The Advance Fund is supporting nonprofits, social enterprises and small businesses with project financing to advance economic opportunity in San Diego. It funds projects that are too big for microfinance, yet too small for traditional bank financing.

As of December 2020, the fund has disbursed $4.4 million into the community with 14 active borrowers and three exits across the Advance Strategy portfolio.

One successful Advance portfolio exit was Somali Family Service of San Diego, a nonprofit organization serving East African immigrants and refugees in San Diego. Impact investments through the Advance Fund enabled Somali Family Service to jumpstart its micro-enterprise training program for refugee entrepreneurs in San Diego.

Through the Homebuilding Investment Fund, MDF and San Diego Habitat for Humanity partnered to provide an impact investment opportunity to accelerate Habitat’s family homebuilding efforts. The fund allowed Habitat to acquire and build new home sites quickly, while still empowering low-income families to build equity to purchase the homes with generous 30-year mortgages.

Through impact investing and grantmaking, the fund mobilized more than $2 million, resulting in 19 homes built and sold to low-income families in San Diego and El Cajon. The work continues on 18 homes throughout National City, Encinitas, and Escondido for an anticipated total of 37 homes for San Diego families built with support from the fund.

In 2020, The Foundation also partnered with MDF by providing $5 million in seed funding for the San Diego County COVID-19 Small Business & Nonprofit Loan Program, a collaborative initiative launched by County of San Diego Supervisor Nathan Fletcher to provide low-to-no-interest loans to small businesses and nonprofit organizations and aid in the region’s economic recovery from the coronavirus. The first $1.5 million in loans was deployed late last year to eight nonprofits impacted by COVID-19.

Looking ahead, we aim to expand and leverage impact investing to promote the equitable flow of capital for social good in spaces like higher education, employment, childcare, climate and housing.

Do you want to learn more about making a difference through impact investing? Read about our Impact Investing Fund today to see how you can get involved.