Your legacy. Tomorrow's reality.

We’re here now. But, one day, we’ll be gone.

What will you leave behind for San Diego?

Download: Guide to Building Your Charitable Legacy

Start Your

Charitable Legacy.

Giving back can last a lifetime and beyond.

A legacy fund provides lasting benefits to you, your family and the causes and charities you care about.

Consult with a Giving Expert

Or, download this guide to learn more.

Leave a Legacy of Giving.

General

Individual & Family Giving

Legacy Giving

Community Impact

How Does A Legacy Fund Work?

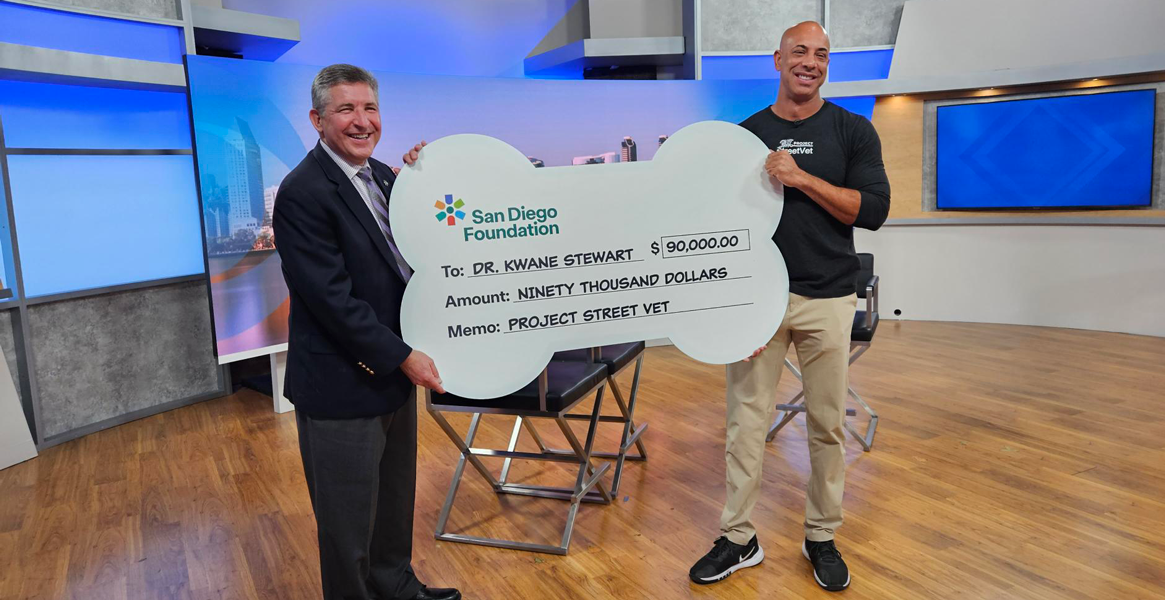

With a planned gift to San Diego Foundation, you can direct the lasting change you want to make.

Set up your legacy fund in four easy steps:

Draft a fund agreement.

Your fund agreement is a product of your own passions, cares and concerns. Include how you want to contribute to your fund, what your fund will support and a succession plan.

Contribute to your fund.

Contribute to your fund during your lifetime and claim an income tax deduction. Or, contribute through a charitable bequest, and benefit from an estate tax deduction. See more giving options.

Grow your charitable assets.

Guided by our Investment Committee, your contributions are invested into one of our investment portfolios based on your goals. As your assets grow tax-free, so does your charitable impact.

Support causes that are meaningful to you.

Dollars granted from your fund – either by SDF or your appointed successors – will support nonprofits, causes and initiatives that align with the passions and values you outline in your agreement.

Ready to start your charitable legacy?

Set up a one-on-one consultation with our Giving Experts today.

What Can I Give?

You can contribute assets to your legacy fund during your lifetime or after you pass away.

Give while you live.

You can make a gift to your legacy fund during your lifetime and claim an income tax deduction.

Gifts of cash are deductible up to 60% of adjusted gross income in the year of the contribution, with a five-year carryover for the excess not used. If you contribute appreciated stock or other real property, capital gain taxes are eliminated, and you can take a charitable deduction for the fair market value of the gift, up to 30% of your adjusted gross income.

Live, then give.

You can set up a planned gift to be contributed after your passing and benefit from an estate tax deduction.

Planned giving options include:

-

Bequest by Will or Living Trust

-

Donor-Advised Fund

-

Charitable Gift Annuity

-

Charitable Remainder Trust

-

Charitable Lead Trust

-

Charitable Endowment

-

Life Insurance Policy

-

IRA, 401(k) or Other Retirement Assets

-

Custom Estate Plan for Business, Investments or Child with Special Needs

Make Your Legacy

A Reality.

San Diegans are as varied as pebbles on the beach, but we’re united for a single purpose: creating a better community for all.

Let us help you make your legacy a reality.

Telephone Email Consult with a Giving Expert